Stafford County Property Tax Rate 2021 . the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on a median home value. the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. The tax rate is set by the board of supervisors in. Rate per $100 of assessed valuation. the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate.

from exohtntjr.blob.core.windows.net

The tax rate is set by the board of supervisors in. the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on a median home value. at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. Rate per $100 of assessed valuation. the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,.

Stafford County Personal Property Tax Rate at Eric Whitlow blog

Stafford County Property Tax Rate 2021 the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. The tax rate is set by the board of supervisors in. the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate. the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. Rate per $100 of assessed valuation. the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on a median home value. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,.

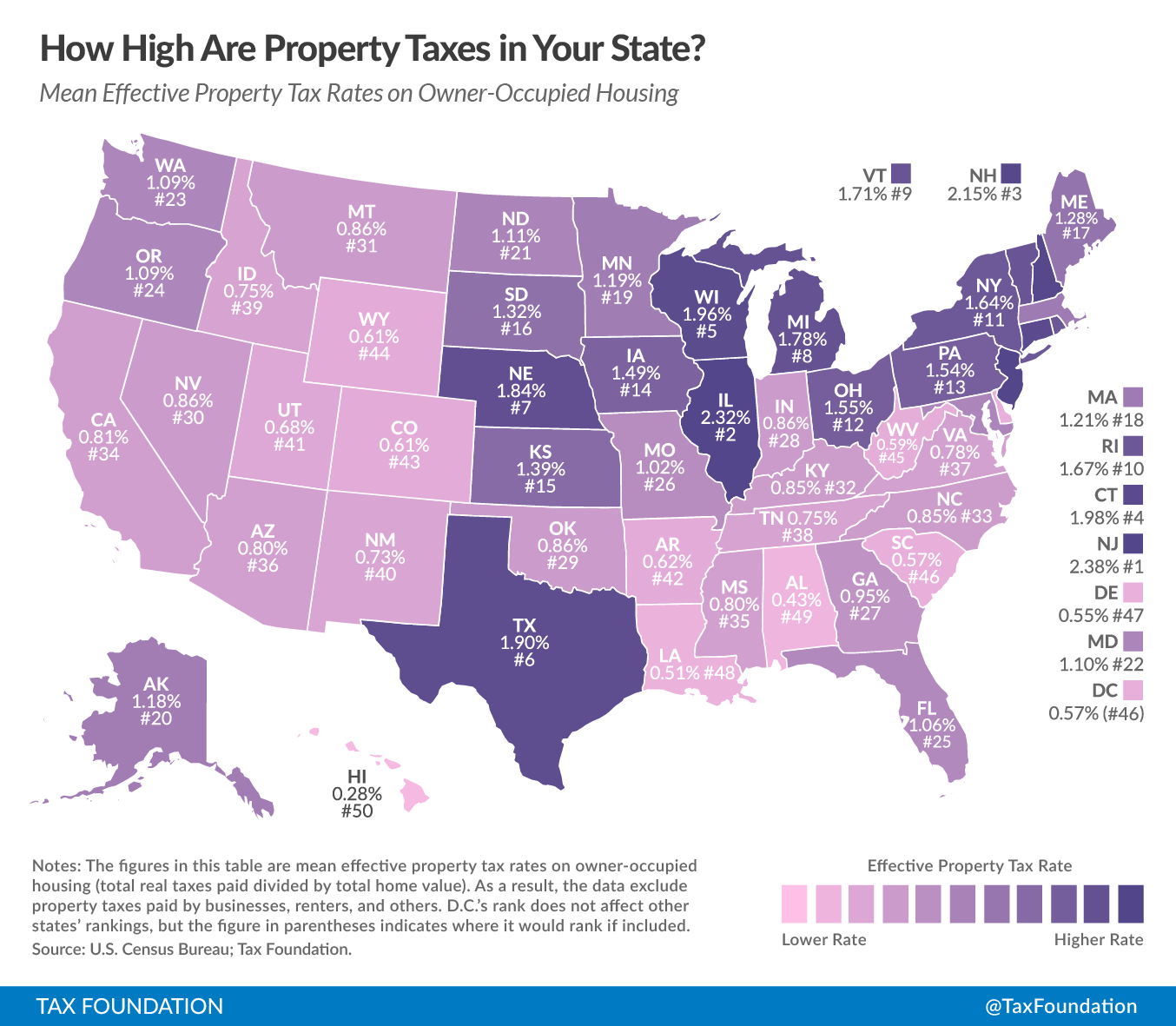

From taxfoundation.org

State Estate Tax Rates & State Inheritance Tax Rates Tax Foundation Stafford County Property Tax Rate 2021 the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on a median home value. Rate per $100 of assessed valuation. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. the real estate tax rate for calendar year. Stafford County Property Tax Rate 2021.

From downtownstafford.com

What's Next Downtown Stafford Downtown Stafford Stafford County Property Tax Rate 2021 The tax rate is set by the board of supervisors in. at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. Rate per $100 of assessed valuation. the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget. Stafford County Property Tax Rate 2021.

From dorriqmaryann.pages.dev

Federal Estate Tax Rates 2024 Norah Annelise Stafford County Property Tax Rate 2021 at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. the real estate tax rate for calendar year 2021 is adopted at $0.97, and the. Stafford County Property Tax Rate 2021.

From txcip.org

Texas Counties Total County Property Tax Rate Stafford County Property Tax Rate 2021 the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. Rate per $100 of assessed valuation. the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on a median home value. the real estate tax rate for. Stafford County Property Tax Rate 2021.

From stories.opengov.com

FY22 0109 Stafford County Map Stafford County Property Tax Rate 2021 the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate. The tax rate is set by the board of supervisors in. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. the real. Stafford County Property Tax Rate 2021.

From theonlinetaxguy.com

to gauge whether your state s property tax structure has Stafford County Property Tax Rate 2021 at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. the median property tax (also known as real estate tax) in stafford county is $2,477.00. Stafford County Property Tax Rate 2021.

From keenansheffield.blogspot.com

florida estate tax rates 2021 Keenan Sheffield Stafford County Property Tax Rate 2021 the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. The tax rate is set by the board of supervisors in. the median property tax. Stafford County Property Tax Rate 2021.

From lakeshiapenn.blogspot.com

mississippi state tax rate 2021 Lakeshia Penn Stafford County Property Tax Rate 2021 the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate. the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. real estate taxes are proposed to increase as much as 4%,. Stafford County Property Tax Rate 2021.

From cevxprsp.blob.core.windows.net

Yorktown Property Tax Rate at Marilyn Strother blog Stafford County Property Tax Rate 2021 the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate. the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. Rate per $100 of assessed valuation. at its march 16 meeting,. Stafford County Property Tax Rate 2021.

From taxfoundation.org

2023 State Estate Taxes and State Inheritance Taxes Stafford County Property Tax Rate 2021 The tax rate is set by the board of supervisors in. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. Rate per $100 of assessed valuation. the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on a median. Stafford County Property Tax Rate 2021.

From dxokfypvu.blob.core.windows.net

Tax Rate In England 2021 at Brenda Hines blog Stafford County Property Tax Rate 2021 real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. The tax rate is set by the board of supervisors in. at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. the real estate tax. Stafford County Property Tax Rate 2021.

From exohtntjr.blob.core.windows.net

Stafford County Personal Property Tax Rate at Eric Whitlow blog Stafford County Property Tax Rate 2021 the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on a median home value. the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate. at its march 16 meeting, the board of supervisors voted. Stafford County Property Tax Rate 2021.

From cepqglcw.blob.core.windows.net

Property Tax Rate In Porter County Indiana at Micheal Geddes blog Stafford County Property Tax Rate 2021 Rate per $100 of assessed valuation. The tax rate is set by the board of supervisors in. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at. Stafford County Property Tax Rate 2021.

From keeleywavis.pages.dev

Property Tax Philadelphia 2024 Helen Caterina Stafford County Property Tax Rate 2021 the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate. at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. real estate taxes are proposed to increase as much as 4%,. Stafford County Property Tax Rate 2021.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Stafford County Property Tax Rate 2021 at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. Rate per $100 of assessed valuation. the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on a median home value. the real estate tax rate for. Stafford County Property Tax Rate 2021.

From classcampusenrique.z19.web.core.windows.net

Information On Property Taxes Stafford County Property Tax Rate 2021 The tax rate is set by the board of supervisors in. the real estate tax rate for calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax. the real estate tax rate for the calendar year 2021 is adopted at $0.97, and the fy2022 adopted budget assumes the same tax rate. . Stafford County Property Tax Rate 2021.

From marthawgina.pages.dev

Nc County Property Tax Rates 2024 Genni Josepha Stafford County Property Tax Rate 2021 at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. real estate taxes are proposed to increase as much as 4%, and personal property taxes would be assessed at 50%,. the real estate tax rate for the calendar year 2021 is adopted at $0.97, and. Stafford County Property Tax Rate 2021.

From ceowrrxo.blob.core.windows.net

Va Stafford County Property Tax at Ralph Thacker blog Stafford County Property Tax Rate 2021 Rate per $100 of assessed valuation. at its march 16 meeting, the board of supervisors voted to advertise the calendar year 2021 real estate tax rate at $1.01. The tax rate is set by the board of supervisors in. the median property tax (also known as real estate tax) in stafford county is $2,477.00 per year, based on. Stafford County Property Tax Rate 2021.